For many people today, practical atheism is the normal rule of life...If this attitude becomes a general existential position, then freedom no longer has any standards, then everyting is possible and permissible.

Distinction Matter - Subscribed Feeds

-

Site: AsiaNews.itAccording to police, the lone, armed man who carried out the attack early this morning belonged to Southeast Asian terrorist group Jemaah Islamiyah, responsible for the 2002 Bali bombings that killed more than 200 people.

-

Site: Mises InstituteMonth-to-month money-supply growth turned positive in March, and money growth hit a two-year high. The Fed clearly has no appetite for more monetary "tightening."

-

Site: Saint Louis Catholic

-

Site: Zero HedgeWith Momentum In Its Favor, Gold Has Potential To Head HigherTyler Durden Fri, 05/17/2024 - 11:40

Authored by Ven Ram, Bloomberg cross-asset strategist,

Gold looks well poised to build on this year’s gains, with speculative momentum seeming to entice marginal buying and perpetrating a virtuous circle.

Bullion is on track for a fourth successive monthly rally, with its gains so far this year of over 15%.

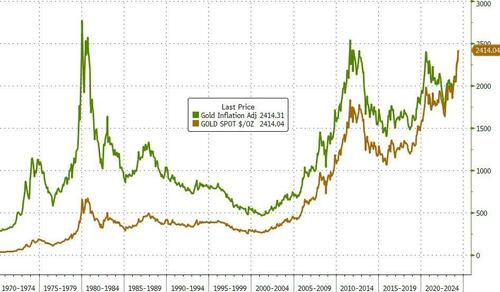

While those gains appear stunning, in reality, gold adjusted for prices in the economy is far less impressive. At around $2400, it is in line with the 2011/12 highs after adjusting for inflation.

Gold must be viewed for what it actually is: an asset that delivers inflation-adjusted returns in fits and spurts with a highly inconsistent trajectory. Even so, given that we are now in a world where there is little conviction of returning to a 2% inflation regime anytime soon, bullion has room to grind higher.

Over in the US, the markets are again warming up to the idea of interest rate cuts from the Fed after the softer-than-forecast inflation prints for April. Traders now seem to be converging on September for a first reduction and are factoring in nearly two cuts by year-end. Whether or not that positioning proves accurate needs to be seen, but gold traders will be inclined to price those cuts into bullion pricing first and ask questions later.

And with geopolitical tensions staying elevated, gold will find the extra bid going in its favor.

-

Site: Zero HedgeWith Momentum In Its Favor, Gold Has Potential To Head HigherTyler Durden Fri, 05/17/2024 - 11:40

Authored by Ven Ram, Bloomberg cross-asset strategist,

Gold looks well poised to build on this year’s gains, with speculative momentum seeming to entice marginal buying and perpetrating a virtuous circle.

Bullion is on track for a fourth successive monthly rally, with its gains so far this year of over 15%.

While those gains appear stunning, in reality, gold adjusted for prices in the economy is far less impressive. At around $2400, it is in line with the 2011/12 highs after adjusting for inflation.

Gold must be viewed for what it actually is: an asset that delivers inflation-adjusted returns in fits and spurts with a highly inconsistent trajectory. Even so, given that we are now in a world where there is little conviction of returning to a 2% inflation regime anytime soon, bullion has room to grind higher.

Over in the US, the markets are again warming up to the idea of interest rate cuts from the Fed after the softer-than-forecast inflation prints for April. Traders now seem to be converging on September for a first reduction and are factoring in nearly two cuts by year-end. Whether or not that positioning proves accurate needs to be seen, but gold traders will be inclined to price those cuts into bullion pricing first and ask questions later.

And with geopolitical tensions staying elevated, gold will find the extra bid going in its favor.

-

Site: Zero HedgeWith Momentum In Its Favor, Gold Has Potential To Head HigherTyler Durden Fri, 05/17/2024 - 11:40

Authored by Ven Ram, Bloomberg cross-asset strategist,

Gold looks well poised to build on this year’s gains, with speculative momentum seeming to entice marginal buying and perpetrating a virtuous circle.

Bullion is on track for a fourth successive monthly rally, with its gains so far this year of over 15%.

While those gains appear stunning, in reality, gold adjusted for prices in the economy is far less impressive. At around $2400, it is in line with the 2011/12 highs after adjusting for inflation.

Gold must be viewed for what it actually is: an asset that delivers inflation-adjusted returns in fits and spurts with a highly inconsistent trajectory. Even so, given that we are now in a world where there is little conviction of returning to a 2% inflation regime anytime soon, bullion has room to grind higher.

Over in the US, the markets are again warming up to the idea of interest rate cuts from the Fed after the softer-than-forecast inflation prints for April. Traders now seem to be converging on September for a first reduction and are factoring in nearly two cuts by year-end. Whether or not that positioning proves accurate needs to be seen, but gold traders will be inclined to price those cuts into bullion pricing first and ask questions later.

And with geopolitical tensions staying elevated, gold will find the extra bid going in its favor.

-

Site: Mises InstituteHuman Action is the antidote to the real and immediate threat to human liberty and society by progressivism.

-

Site: Mises InstitutePresented at the 2024 Human Action Conference in Auburn, Alabama.

-

Site: LifeNews

A judge has blocked an attempt by the Planned Parenthood abortion business to strike down the South Carolina heartbeat law that is saving babies from abortions.

Circuit Court Judge Daniel Coble denied the motion from the abortion giant to hit pause on the pro-life law despite false claims from Planned Parenthood that the law doesn’t give a specific timeline when an unborn baby’s heartbeat can be detected.

Coble said the state legislature clearly intended the law to begin applying an abortion ban at 6 weeks, when an unborn child’s heartbeat can clearly be detected on a sonogram. The judge also referenced the frequent use of six weeks in the South Carolina Supreme Court case last year, nothing that pro-life and pro-abortion legislators both called it a 6-week abortion ban.

“This court holds that it is clear beyond a shadow of a doubt that the General Assembly intended, and the public understood, that the time frame of the act would begin around the six-week mark,” Coble wrote in his decision.

Coble said the term “fetal heartbeat” is somewhat vague, but it does not meet the standard to be considered unconstitutional.

Click here to sign up for pro-life news alerts from LifeNews.com

“The definition of ‘fetal heartbeat’ is not clear and unambiguous and does not convey a definite meaning on its face,” Coble wrote. “Therefore, this Court must look to the intent of the General Assembly in determining, if possible, what it envisioned.”

The state argued “an embryo’s heart is beating steadily, repetitively and rhythmically” at the six-week mark but Planned Parenthood argued the abortion bans should not go into effect until 9 weeks.

The state Supreme Court ruled in August that the state’s fetal heartbeat law is constitutional.

Gov. Henry McMaster’s office called the decision “another legal victory” for the state’s heartbeat law.

“Life will continue to be protected in South Carolina, and the governor will continue his fight to protect it,” McMaster spokesman Brandon Charochak said in a statement.

The Planned Parenthood abortion business is expected to appeal.

The post South Carolina Judge Rejects Planned Parenthood Demand to Strike Down Heartbeat Law appeared first on LifeNews.com.

-

Site: Zero HedgeChinese FX Outflows Soar To Highest Since 2015 Devaluation, Priming Next Bitcoin SurgeTyler Durden Fri, 05/17/2024 - 11:20

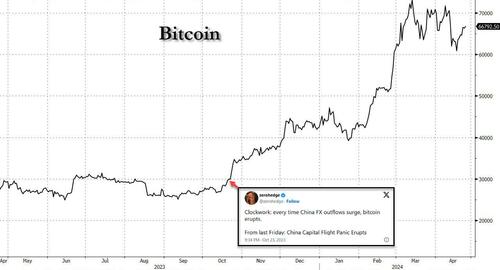

Last October, when we pointed out that China's FX outflows had just hit a whopping $75BN - the single biggest monthly outflow since the 2015 currency devaluation - we concluded that the "unfavorable interest rate spread between China and the US will "likely imply persistent depreciation and outflow pressures in coming months", or in other words, September's biggest FX outflow in years is just the beginning, and very soon - in addition to geopolitics and central banks - the world will also be freaking out about the capital flight out of China... not to mention where all those billions in Chinese savings are going and which digital currency the Chinese are using to launder said outflows."

We wrote that on October 20 when Bitcoin was trading just under $30,000, a level it had been for much of 2023. And, just as we correctly predicted at the time...

Clockwork: every time China FX outflows surge, bitcoin erupts.

— zerohedge (@zerohedge) October 24, 2023

From last Friday: China Capital Flight Panic Eruptshttps://t.co/j0eWLnbFMq... following this surge in Chinese FX outflows, bitcoin - traditionally China's preferred means to circumvent Beijing's great capital firewall since gold is, how should one put it, a bit more obvious when crossing borders - promptly exploded more than 100% higher in the next 4 months.

And while conventional wisdom is that this surge in the price of the digital currency was largely due to the January launch of Bitcoin ETFs, what many missed was a Reuters story in January which reiterated our original thesis from back in 2015, according to which much more than ETFs, and much more than rapidly shifting sentiment or frankly any day-to-day newsflow, it is China's massive wall of inert capital that has been the biggest driver of bitcoin moves, and never more so than during periods of FX and capital outflows which usually precede some form of capital controls.

We bring all this up because seven months after our first correct prediction that China's spike in FX outflows would send bitcoin surging, it's time to do it again.

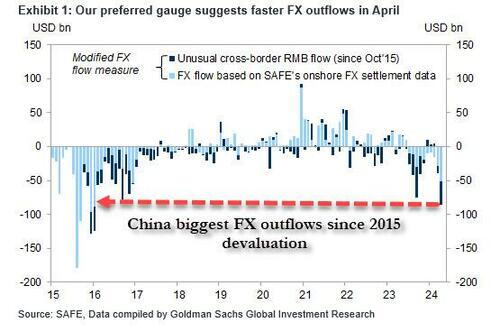

One wouldn't know it, however, if one merely looked at the official Chinese FX reserve data published by the PBOC, here nothing sticks out. In fact, at $3.2 trillion, despite a rather notable drop for April, reported Chinese reserves are now near the highest level in past four years, and monthly flows are very much stable as shown in the chart below.

The problem, of course, is that as we have explained previously China's officially reported reserves are woefully (and purposefully) inaccurate of the bigger picture.

Instead if one uses our preferred gauge of FX flows, one which looks at i) onshore outright spot transactions; ii) freshly entered and canceled forward transactions, and iii) the SAFE dataset on “cross-border RMB flows, we find that China's net outflows were a massive $86BN in April, up from $11BN in February and $39BN in March and the fastest pace of outflows since the September spike in FX outflows which we duly noted half a year ago.

Drilling down, in April, we saw $50BN in net outflows via onshore outright spot transactions, and $1BN outflows via freshly entered and canceled forward transactions. Another SAFE dataset on "cross-border RMB flows" showed outflows of $35bn in the month, suggesting net receipt of RMB from onshore to offshore, likely on the back of Stock Connect outflows, but the "unusual flow" really could be anything including the unexplained capital flight into gold and bitcoin. Ours - and Goldman's - preferred FX flow measure therefore suggests FX outflows were really $86BN in April, more than double the official net FX outflows of $39BN in the month.

How did we get this number? First, the portfolio investment channel showed net outflows in March after adjusting for cross-border RMB receipts. Stock Connect flows showed around US$9bn outflows, vs. US$8bn outflows in March. Foreigners kept buying RMB bonds - the bond market saw US$7bn inflows in April, vs. US$6bn in March.

Finally, the current account channel also showed faster net outflows. Despite a sizeable goods trade surplus in April, we saw a small outflow of $2bn related to goods trade in April vs. an inflow of $14bn in March. The services trade deficit widened to $22bn vs. $18bn in March. The income and transfers account showed outflows of $5bn in April, faster than the $2bn outflows in March.

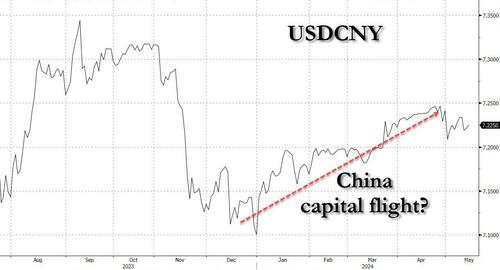

At the time when FX outflows were re-acclererating, the broad USD strengthened further in April, and more importantly, the USDCNY spot drifted higher, as one would expect when there is capital flight... Oh, and Bitcoin traded at its record high above $70K.

And while Chinese policymakers are still keen on maintaining FX stability (or at least create that impression) as the countercyclical factors in the daily CNY fixing remained deeply negative and front-end CNH liquidity tightened notably in recent weeks, the reality is that with China desperate to boost its exports at a time when its great mercantilist competitor, Japan, has hammered the yen to the lowest level in 3 decades, it is only a matter of time before the currency devaluation advocates win, as they did in 2015.

We hope that we don't have to remind readers that the first big trigger for bitcoin's unprecedented eruption higher starting in 2015 was - you guessed it - China's August 2015 FX devaluation, as we correctly noted at the time when we predicted that bitcoin would explode from $250 to the tens of thousands.

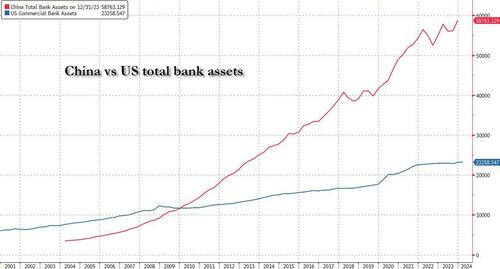

So don't be surprised if in the next 6 months Bitcoin doubles again, and the move has nothing to do with ETF inflows, the halving, or frankly anything else taking place in the US... and instead is entirely driven by China's massive wall of money which at last check was almost 3x bigger than the US.

-

Site: Zero HedgeChinese FX Outflows Soar To Highest Since 2015 Devaluation, Priming Next Bitcoin SurgeTyler Durden Fri, 05/17/2024 - 11:20

Last October, when we pointed out that China's FX outflows had just hit a whopping $75BN - the single biggest monthly outflow since the 2015 currency devaluation - we concluded that the "unfavorable interest rate spread between China and the US will "likely imply persistent depreciation and outflow pressures in coming months", or in other words, September's biggest FX outflow in years is just the beginning, and very soon - in addition to geopolitics and central banks - the world will also be freaking out about the capital flight out of China... not to mention where all those billions in Chinese savings are going and which digital currency the Chinese are using to launder said outflows."

We wrote that on October 20 when Bitcoin was trading just under $30,000, a level it had been for much of 2023. And, just as we correctly predicted at the time...

Clockwork: every time China FX outflows surge, bitcoin erupts.

— zerohedge (@zerohedge) October 24, 2023

From last Friday: China Capital Flight Panic Eruptshttps://t.co/j0eWLnbFMq... following this surge in Chinese FX outflows, bitcoin - traditionally China's preferred means to circumvent Beijing's great capital firewall since gold is, how should one put it, a bit more obvious when crossing borders - promptly exploded more than 100% higher in the next 4 months.

And while conventional wisdom is that this surge in the price of the digital currency was largely due to the January launch of Bitcoin ETFs, what many missed was a Reuters story in January which reiterated our original thesis from back in 2015, according to which much more than ETFs, and much more than rapidly shifting sentiment or frankly any day-to-day newsflow, it is China's massive wall of inert capital that has been the biggest driver of bitcoin moves, and never more so than during periods of FX and capital outflows which usually precede some form of capital controls.

We bring all this up because seven months after our first correct prediction that China's spike in FX outflows would send bitcoin surging, it's time to do it again.

One wouldn't know it, however, if one merely looked at the official Chinese FX reserve data published by the PBOC, here nothing sticks out. In fact, at $3.2 trillion, despite a rather notable drop for April, reported Chinese reserves are now near the highest level in past four years, and monthly flows are very much stable as shown in the chart below.

The problem, of course, is that as we have explained previously China's officially reported reserves are woefully (and purposefully) inaccurate of the bigger picture.

Instead if one uses our preferred gauge of FX flows, one which looks at i) onshore outright spot transactions; ii) freshly entered and canceled forward transactions, and iii) the SAFE dataset on “cross-border RMB flows, we find that China's net outflows were a massive $86BN in April, up from $11BN in February and $39BN in March and the fastest pace of outflows since the September spike in FX outflows which we duly noted half a year ago.

Drilling down, in April, we saw $50BN in net outflows via onshore outright spot transactions, and $1BN outflows via freshly entered and canceled forward transactions. Another SAFE dataset on "cross-border RMB flows" showed outflows of $35bn in the month, suggesting net receipt of RMB from onshore to offshore, likely on the back of Stock Connect outflows, but the "unusual flow" really could be anything including the unexplained capital flight into gold and bitcoin. Ours - and Goldman's - preferred FX flow measure therefore suggests FX outflows were really $86BN in April, more than double the official net FX outflows of $39BN in the month.

How did we get this number? First, the portfolio investment channel showed net outflows in March after adjusting for cross-border RMB receipts. Stock Connect flows showed around US$9bn outflows, vs. US$8bn outflows in March. Foreigners kept buying RMB bonds - the bond market saw US$7bn inflows in April, vs. US$6bn in March.

Finally, the current account channel also showed faster net outflows. Despite a sizeable goods trade surplus in April, we saw a small outflow of $2bn related to goods trade in April vs. an inflow of $14bn in March. The services trade deficit widened to $22bn vs. $18bn in March. The income and transfers account showed outflows of $5bn in April, faster than the $2bn outflows in March.

At the time when FX outflows were re-acclererating, the broad USD strengthened further in April, and more importantly, the USDCNY spot drifted higher, as one would expect when there is capital flight... Oh, and Bitcoin traded at its record high above $70K.

And while Chinese policymakers are still keen on maintaining FX stability (or at least create that impression) as the countercyclical factors in the daily CNY fixing remained deeply negative and front-end CNH liquidity tightened notably in recent weeks, the reality is that with China desperate to boost its exports at a time when its great mercantilist competitor, Japan, has hammered the yen to the lowest level in 3 decades, it is only a matter of time before the currency devaluation advocates win, as they did in 2015.

We hope that we don't have to remind readers that the first big trigger for bitcoin's unprecedented eruption higher starting in 2015 was - you guessed it - China's August 2015 FX devaluation, as we correctly noted at the time when we predicted that bitcoin would explode from $250 to the tens of thousands.

So don't be surprised if in the next 6 months Bitcoin doubles again, and the move has nothing to do with ETF inflows, the halving, or frankly anything else taking place in the US... and instead is entirely driven by China's massive wall of money which at last check was almost 3x bigger than the US.

-

Site: Zero HedgeChinese FX Outflows Soar To Highest Since 2015 Devaluation, Priming Next Bitcoin SurgeTyler Durden Fri, 05/17/2024 - 11:20

Last October, when we pointed out that China's FX outflows had just hit a whopping $75BN - the single biggest monthly outflow since the 2015 currency devaluation - we concluded that the "unfavorable interest rate spread between China and the US will "likely imply persistent depreciation and outflow pressures in coming months", or in other words, September's biggest FX outflow in years is just the beginning, and very soon - in addition to geopolitics and central banks - the world will also be freaking out about the capital flight out of China... not to mention where all those billions in Chinese savings are going and which digital currency the Chinese are using to launder said outflows."

We wrote that on October 20 when Bitcoin was trading just under $30,000, a level it had been for much of 2023. And, just as we correctly predicted at the time...

Clockwork: every time China FX outflows surge, bitcoin erupts.

— zerohedge (@zerohedge) October 24, 2023

From last Friday: China Capital Flight Panic Eruptshttps://t.co/j0eWLnbFMq... following this surge in Chinese FX outflows, bitcoin - traditionally China's preferred means to circumvent Beijing's great capital firewall since gold is, how should one put it, a bit more obvious when crossing borders - promptly exploded more than 100% higher in the next 4 months.

And while conventional wisdom is that this surge in the price of the digital currency was largely due to the January launch of Bitcoin ETFs, what many missed was a Reuters story in January which reiterated our original thesis from back in 2015, according to which much more than ETFs, and much more than rapidly shifting sentiment or frankly any day-to-day newsflow, it is China's massive wall of inert capital that has been the biggest driver of bitcoin moves, and never more so than during periods of FX and capital outflows which usually precede some form of capital controls.

We bring all this up because seven months after our first correct prediction that China's spike in FX outflows would send bitcoin surging, it's time to do it again.

One wouldn't know it, however, if one merely looked at the official Chinese FX reserve data published by the PBOC, here nothing sticks out. In fact, at $3.2 trillion, despite a rather notable drop for April, reported Chinese reserves are now near the highest level in past four years, and monthly flows are very much stable as shown in the chart below.

The problem, of course, is that as we have explained previously China's officially reported reserves are woefully (and purposefully) inaccurate of the bigger picture.

Instead if one uses our preferred gauge of FX flows, one which looks at i) onshore outright spot transactions; ii) freshly entered and canceled forward transactions, and iii) the SAFE dataset on “cross-border RMB flows, we find that China's net outflows were a massive $86BN in April, up from $11BN in February and $39BN in March and the fastest pace of outflows since the September spike in FX outflows which we duly noted half a year ago.

Drilling down, in April, we saw $50BN in net outflows via onshore outright spot transactions, and $1BN outflows via freshly entered and canceled forward transactions. Another SAFE dataset on "cross-border RMB flows" showed outflows of $35bn in the month, suggesting net receipt of RMB from onshore to offshore, likely on the back of Stock Connect outflows, but the "unusual flow" really could be anything including the unexplained capital flight into gold and bitcoin. Ours - and Goldman's - preferred FX flow measure therefore suggests FX outflows were really $86BN in April, more than double the official net FX outflows of $39BN in the month.

How did we get this number? First, the portfolio investment channel showed net outflows in March after adjusting for cross-border RMB receipts. Stock Connect flows showed around US$9bn outflows, vs. US$8bn outflows in March. Foreigners kept buying RMB bonds - the bond market saw US$7bn inflows in April, vs. US$6bn in March.

Finally, the current account channel also showed faster net outflows. Despite a sizeable goods trade surplus in April, we saw a small outflow of $2bn related to goods trade in April vs. an inflow of $14bn in March. The services trade deficit widened to $22bn vs. $18bn in March. The income and transfers account showed outflows of $5bn in April, faster than the $2bn outflows in March.

At the time when FX outflows were re-acclererating, the broad USD strengthened further in April, and more importantly, the USDCNY spot drifted higher, as one would expect when there is capital flight... Oh, and Bitcoin traded at its record high above $70K.

And while Chinese policymakers are still keen on maintaining FX stability (or at least create that impression) as the countercyclical factors in the daily CNY fixing remained deeply negative and front-end CNH liquidity tightened notably in recent weeks, the reality is that with China desperate to boost its exports at a time when its great mercantilist competitor, Japan, has hammered the yen to the lowest level in 3 decades, it is only a matter of time before the currency devaluation advocates win, as they did in 2015.

We hope that we don't have to remind readers that the first big trigger for bitcoin's unprecedented eruption higher starting in 2015 was - you guessed it - China's August 2015 FX devaluation, as we correctly noted at the time when we predicted that bitcoin would explode from $250 to the tens of thousands.

So don't be surprised if in the next 6 months Bitcoin doubles again, and the move has nothing to do with ETF inflows, the halving, or frankly anything else taking place in the US... and instead is entirely driven by China's massive wall of money which at last check was almost 3x bigger than the US.

-

Site: LifeNews

It was the murder trial of the century. Scott Peterson was tried and convicted of killing his wife Laci when she was eight months pregnant with their son Connor. After the bodies of his wife and child washed up on shore Scott was sentenced to life in prison without the opportunity for parole.

That trial captivated millions of Americans and showcased a serious problem in America.

Murder is one of the leading causes of death for pregnant women according to a study funded by the National Institute of Child Health and Human Development. Women who are pregnant or up to one year postpartum have a 35% higher risk of dying by homicide than women who were not pregnant.

The Laci Peterson case isn’t alone in grabbing headlines. A quick online search produced these more recent cases which according to statistics are just the tip of the iceberg, abortion is a tool of control.

Logan Barclay of Wisconsin was arrested in April 2024 for the death of his pregnant girlfriend. He

confessed to shooting Kiersten Hansen because she was pregnant and refused to get an abortion. Barclay told detectives that when she wouldn’t stop talking about the pregnancy, he shot her in the stomach. He told police that when he shot her, she “freaked out and dropped to her knee, and I walked away.”

confessed to shooting Kiersten Hansen because she was pregnant and refused to get an abortion. Barclay told detectives that when she wouldn’t stop talking about the pregnancy, he shot her in the stomach. He told police that when he shot her, she “freaked out and dropped to her knee, and I walked away.”Click here to sign up for pro-life news alerts from LifeNews.com

Karylin Fiengo was shot and left in a Florida park. She was approximately 12 weeks pregnant at the time. Her boyfriend, Donovan Faison was arrested and charged with two counts of felony homicide – one for the mother and another for her unborn child. Faison was angry that Karylin refused to have an abortion.

Karylin Fiengo was shot and left in a Florida park. She was approximately 12 weeks pregnant at the time. Her boyfriend, Donovan Faison was arrested and charged with two counts of felony homicide – one for the mother and another for her unborn child. Faison was angry that Karylin refused to have an abortion.Raquiah King was found with a bullet in her back. The autopsy showed she was 12 weeks pregnant. Emmanuel Coble, her partner, did not want to be a father. After considerable pressure, he coerced her into making an appointment for an abortion at Planned Parenthood, but once there Raquiah changed her mind.

Her mother reported that Raquiah told her if anything happened to her, Emmanuel was responsible. Coble, a junior grade lieutenant in the US Navy was arrested and charged with the deaths of his girlfriend and their unborn child. Candace Pickens loved being a mom to her three-year-old son Zachaeus and rebuffed her partner, Nathaniel Dixon’s insistence she get an abortion. In an act of pure evil, Dixon executed Candace at close range with a gun. Compounding this heartless violence he also shot Zachaeus in the head, but the child survived. The boy now lives with the memory of seeing his mother brutally killed. Dixon was charged with first-degree murder and attempted first-degree murder.

Candace Pickens loved being a mom to her three-year-old son Zachaeus and rebuffed her partner, Nathaniel Dixon’s insistence she get an abortion. In an act of pure evil, Dixon executed Candace at close range with a gun. Compounding this heartless violence he also shot Zachaeus in the head, but the child survived. The boy now lives with the memory of seeing his mother brutally killed. Dixon was charged with first-degree murder and attempted first-degree murder.Research shows that as many as 64% of American women feel coerced or forced into having an abortion. Another study shows the incidence of pregnancy-associated murders is rising in the United States.

This is further evidence that abortion hasn’t liberated women. Abortion is a tool of control. It is being used manipulate their behavior and in a growing number of cases, because it has debased the value of women, their lifeless bodies are cast aside if they don’t do their partners’ bidding.

LifeNews.com Note: Bradley Mattes is the President of Life Issues Institute, a national pro-life educational group.

The post Predators Use Abortion as Tool of Control, Killing Women Who Refuse to Have One appeared first on LifeNews.com.

-

Site: The Orthosphere

“Many persons . . . pronounce Antinominaism to be nothing more than Calvinism run to seed”

John Evans, A Sketch of the Denominations of the Christian World (1808)*

The political scientist C. Northcote Parkinson once said that the road from aristocracy to democracy begins with sympathy for younger brothers. To endure as a exclusive elect, an aristocracy must enforce rigid primogeniture, priority in birth-order being the indispensable requirement for election. But fraternal affection and a healthy fear of assassination caused high-born big brothers to cut their little brothers some slack, and the trek to democracy was begun.

Robert Frost tells us that there is something that does not love a wall, and there is likewise something that does not like a cutoff. I say this as a professor who has just passed through the furnace of final grades, and whose ears are therefore ringing with the lamentations of students who wound up one point below the cutoff for an A, or a B, or a C, or a D. Pointing to the students who wound up one point above the cutoff, these malcontents reproach me with the words, “there but for a miserable two points go I!”

These are not trivial arguments. Another American poet, John Greenleaf Whittier, places these mornful words in the mouth of every man who did not “make the grade.”

“Meanwhile, the sport of seeming chance,

The plastic shapes of circumstance,

What might have been we fondly guess

If earlier born, or tempted less.”**Every athlete knows the extraordinary sting of losing a close contest, and I suppose this is why softies began to hand out silver and bronze medals. And once they started handing out silver and bronze medals, they were on the road to ribbons for all.

God’s mercy is of course what my students euphemistically call “extra credit.” Every professor’s semester ends with pleas for “extra credit,” a phrase that in a student’s mouth means that I will raise their score and they will pretend to do extra work. I have often thought that offering me an outright bribe would be more honorable. In any case, the plea for God’s mercy is always a plea that he bend the rules just for me.

I cannot begin to count the times I have explained to an extra-credit-seeking student that I cannot justly raise their score for pretended extra work unless I raise everyone’s score for pretended extra work, and that the result of this charade would be to simply raise the cutoff.

Although, if I am being honest, that would not be the result because it makes me feel good—not just pleasurably but morally good—to simply inflate students’ grades.

It also forfends unpleasantness, and this takes me back to Parkenson’s statement that the political rights of an aristocracy will in time be universalized in a democracy. First the elder brother bestows or finnagles some lesser rank of nobility on his younger brother. Soon after the eldest son of this younger brother bestows or finnagles some some lesser rank of nobility on his younger brother. Before long there is no appreciable difference between the lower orders of the aristocracy and the upper orders of the bourgeoisee. And so on, and so forth, until you extend the franchise to hobos and madmen and women.

Roman Catholics feel good and forefend unpleasantness with the doctrine of Purgatory, which is a sort of spiritual summer school where backwards Catholics (except, perhaps, Adolf Hitler) can earn “extra credit” and graduate in August. There are still cutoffs in this system, at least theoretically, but they are veiled cutoffs, and cutoffs that are veiled soon disappear.

As my epigraph states, Calvinists have their own method of soft-hearted spiritual grade inflation, and this is to progressively lower the cutoff for election until everyone (except, perhaps, Adolf Hitler) gets a passing grade. Thus the old quip that antinomian universalism is “Calvinism run to seed.”

Neither camp has cause to crow. The Catholics end up confident all black sheep straighten up and get their act together in summer school. The Calvinists just universalize the privileges of election.

“Some of their teachers expressly maintained, that as the elect cannot fall from grace, nor forfeit the divine favor, the wicked actions they commit are not really sinful, nor are they to be considered as violations of the divine law; consequently they have no occasion either to confess their sins, or the break them off by repentance.”***

And so by whichever road they take, Christians sooner or later arrive at a doctrine that unites the best parts of atheism and Christianity. This is how the Christian philosopher John Finas described this hybrid of worldly hedonism and Christian hope.

“eat, drink, and be merry—do just what we feel like—for tomorrow we live forever.”†

*) John Evans, A Sketch of the Denominations of the Christian World, Eleventh Edition (London: Crosby and Co, 1808), p. 81.

**) John Greenleaf Whittier, “The Chapel of the Hermits” (1856).

***) Evans, Sketch, pp. 80-81.

†) John Finas, “On the Practical Meaning of Secularism,” Notre Dame Law Review (March 1998): pp. 491-516, quote p. 500. -

Site: Mises InstitutePresented at the 2024 Human Action Conference in Auburn, Alabama.

-

Site: AsiaNews.itIn Bastar, tribal converts to Christianity continue to be attacked. Kosa Kawasi was one of them, killed by an uncle and a cousin. This kind of incidents shows the level of discrimination against people who embrace Christianity in rural villages. 'Christian tribals live in fear and insecurity even among their own families,' a local told AsiaNews.

-

Site: Mises InstituteTom DiLorenzo welcomes attendees to the 2024 Human Action Conference.

-

Site: LifeNews

Gracie Hunt, daughter of the Kanass City Chiefs owner, is defending Harrison Butker from the woke mob after his pro-life Christian graduation speech.

Her remarks on Fox News appear below:

Steve Doocy: “America would like to know the reaction from the Hunt family regarding the kicker, Harrison Butker.”

Gracie Hunt: “I can only speak from my own experience, which is I had the most incredible mom who had the ability to stay home and be with us as kids growing up. And I understand that there are many women out there who can’t make that decision but for me in my life, I know it was really formative in my shaping me and my siblings to be who we are.”

Doocy: “So you understand what he was talking about?”

Hunt: “For sure, and I really respect Harrison and his Christian faith and what he’s accomplished on and off the field.”

HELP LIFENEWS SAVE BABIES FROM ABORTION! Please help LifeNews.com with a donation!

Gracie Hunt, daughter of the Kansas City Chiefs owner, defends Harrison Butker:

“I really respect Harrison and his Christian faith and what he’s accomplished on and off the field.” pic.twitter.com/QME0MRjYtB

— LifeNews.com (@LifeNewsHQ) May 17, 2024

Butker, a three-time Super Bowl-winning kicker for the Kansas City Chiefs, slammed Joe Biden during a commencement speech at Benedictine College recently that has gone viral on social media.

Butker and the college are both Catholic and the NFL player ripped Biden for being a hypocrite – claiming to be Catholic while ignoring the pro-life teachings of the Catholic Church.

The Chiefs player said, “Our own nation is led by a man who proudly proclaims his Catholic faith, but at the same time is delusional enough to make the Sign of The Cross during a pro-abortion rally.”

“He has been so vocal in his support for the murder of innocent babies that I’m sure to many people it appears you can be both Catholic and pro-choice,” Butker added.

The NFL distanced itself from Butker’s comments.

“Harrison Butker gave a speech in his personal capacity. His views are not those of the NFL as an organization. The NFL is steadfast in our commitment to inclusion, which only makes our league stronger,” said NFL DEI officer, Jonathan Beane. “His views are not those of the NFL as an organization. The NFL is steadfast in our commitment to inclusion, which only makes our league stronger.”

In his remarks, Butker also urged the Christian church to stand up stronger for Christian values.

“We need to stop pretending that the church of nice is a winning proposition,” Butker said. “…We must always speak and act in charity. But never mistake charity for cowardice.”

He continued: “The world around us says that we should keep our beliefs to ourselves whenever they go against the tyranny of diversity, equity and inclusion. We fear speaking truth, because now, unfortunately, truth is in the minority.”

The post Gracie Hunt, Daughter of Kansas City Chiefs Owner, Defends Harrison Butker From Woke Mob appeared first on LifeNews.com.

-

Site: LifeNews

Abortion is taking center stage in the race for a seat on the Georgia Supreme Court, as former Democratic U.S. Rep John Barrow challenges incumbent Justice Andrew Pinson.

WABE reported that Barrow has built his campaign almost entirely around promises to keep abortion legal, which critics have said violates judicial codes requiring him to remain impartial.

In response, Barrow has filed a federal lawsuit, claiming that any regulations limiting his ability to share his personal opinions in his campaign violate his First Amendment right to free speech.

Barrow’s campaign this year marks the fourth time he has run for a seat on the state Supreme Court since 2020, but he has never made it to the ballot. Pinson, who has not stated his opinions on abortion, was appointed by Republican Gov. Brian Kemp in 2022.

Prior to filing the lawsuit, Barrow received a judicial ethics complaint, which expressed concern that he stated his views “on highly sensitive disputed legal and/or political issues (which differ from the current state of Georgia law) without also emphasizing the duty of a judge to uphold the Constitution and laws of Georgia.”

The complaint lists seven instances it says Barrow violated the judicial code, including a statement on his website.

Click here to sign up for pro-life news alerts from LifeNews.com

“I’m running because we need Justices on the Georgia Supreme Court who will protect the right of women and their families to make the most personal family and health care decisions they’ll ever make,” Barrow’s website states. “Despite many fine qualities, it’s obvious from his record that the incumbent, Justice Pinson, cannot be counted on to do that.”

The complaint pointed out that justices cannot and should not be expected to protect or fight for selected rights.

Barrow has also posted several statements on Facebook, urging people to vote for him “to keep the rights of healthcare decisions in the hands of women and families!” His campaign commercial reflects similar statements, which earned him more criticism, as it does not promote “public confidence in the independence, integrity, or impartiality of the judiciary.”

A spokesperson for Pinson told WABE that Barrow has ignored Georgia’s judicial ethics code.

“His lawsuit makes clear that his goal is to negatively politicize judicial races and destroy Georgians’ trust in fair and impartial courts,” the spokesperson added.

WABE reported that in Georgia’s contested Supreme Court races, the incumbent has historically almost always won. The only time a challenger won the race against an incumbent was before the Civil War.

WABE added that contested races have previously been apolitical, but the current race between Barrow and Pinson has quickly become partisan thanks to abortion taking center stage.

In early May, several former state justices, Judicial Qualifications Commission officials, and State Bar presidents signed a letter expressing concern about introducing a partisan campaign.

“Judicial candidates are required to stand for election as nonpartisans—after all, justice is not partisan—and they are forbidden by judicial ethics law to make public statements and promises about cases and issues that might come before the court to which they seek election,” the coalition stated, continuing:

If it were otherwise—if judges were permitted to campaign on commitments that they would decide particular cases and issues in particular ways—the courts would become just another political institution, and public confidence in our judicial system would quickly erode. …

There are several contested judicial races on the ballot for the upcoming May 21 elections, including one for Justice of the Georgia Supreme Court. Voters will have the opportunity to demand that our judges be nonpartisan and refrain from making public commitments about how they will decide cases and issues.

According to WABE, Barrow responded to the letter by saying that voters need to know what the justices stand for in order to have confidence in the judiciary.

Barrow is supported by pro-abortion groups, including Planned Parenthood Southeast Advocates. Pro-life groups, including the Georgia Life Alliance, are concerned about the judiciary becoming biased and politicized.

The outcome of the race will be determined by elections on May 21.

LifeNews Note: Hannah Hiester writes for CatholicVote, where this column originally appeared.

The post Radical Abortion Activist John Barrow Wants a Seat on the Georgia Supreme Court appeared first on LifeNews.com.

-

Site: Zero HedgeIs Buffett's Cash Hoard A Market Warning?Tyler Durden Fri, 05/17/2024 - 10:20

Authored by Lance Roberts via RealInvestmentAdvice.com,

Every year, investors anxiously await the release of Warren Buffett’s annual letter to see what the “Oracle of Omaha” says about the markets, the economy, and where he is placing his money.

“One of the longest-running traditions in modern finance is that every year, one Saturday morning in late February, the world’s financial class – from professionals to mere amateurs – sit down as they have for the past 65 or so years – for an hour and read the latest Berkshire annual letter written by Warren Buffett. In that letter, the man seen by many as the world’s greatest investor, wrote down his reflections, observations, aphorisms and other thoughts which are closely parsed and analyzed for insight into what he may do next, what he thinks of the current economy and market climate, or simply for insights into how to become a better investor.” – Tyler Durden

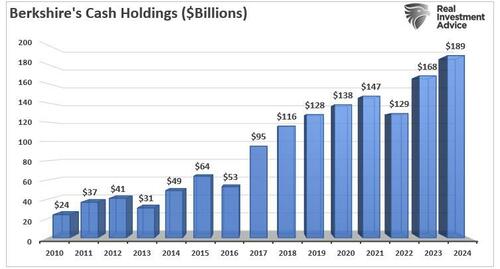

This year’s letter was no different, with various tidbits about the current market and investing environment for investors to digest. The one thing that got most of my attention was his comments about the recent surge in cash holdings. Buffett’s cash and short-term investments (read T-bills) exceed $189 billion as of Q1, 2024.

To put that into context, that $189 billion cash pile alone would make Berkshire the 58th-largest economy in the world, only slightly smaller than Hungary.

There are two critical messages regarding Buffett’s cash hoard. The first is that due to the size of Berkshire Hathaway, which is approaching a $1 Trillion market capitalization, acquisitions have to be of substantial size. As Warren previously noted:

“There remain only a handful of companies in this country capable of truly moving the needle at Berkshire, and they have been endlessly picked over by us and by others. Some we can value; some we can’t. And, if we can, they have to be attractively priced.”

Such was an essential statement. One of the most intelligent investors in history suggests that deploying Buffett’s cash hoard in meaningful size is difficult due to an inability to find reasonably priced acquisition targets. With a $189 war chest, there are plenty of companies that Berkshire could either acquire outright, use a stock/cash offering, or acquire a controlling stake in. However, given the rampant increase in stock prices and valuations over the last decade, they are not reasonably priced.

In other words:

“Price is what you pay, value is what you get.” – Warren Buffett

The Valuation Dilemma

The problem with the valuation dilemma is that historically, such has preceded market repricings.

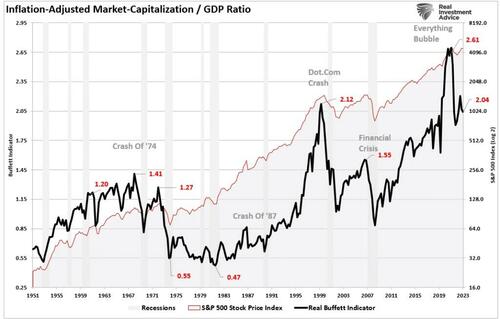

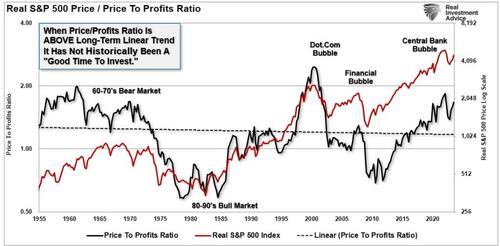

One of Warren Buffett’s favorite valuation measures is the market capitalization to GDP ratio. I have modified it slightly to use inflation-adjusted numbers. This measure is simple: stocks should not trade above the value of the economy. The reason is because economic activity provides revenues and earnings to businesses.

As discussed in “Stock Markets Are Detached From Everything,” the current environment is anything but opportunistic for a value investor like Warren Buffett. To wit:

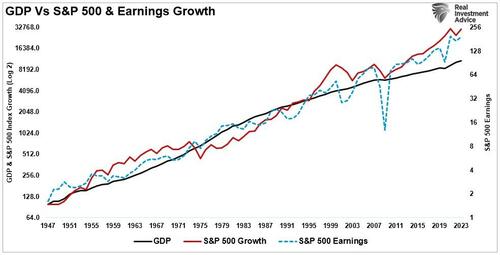

“While stock prices can deviate from immediate activity, reversions to actual economic growth eventually occur. Such is because corporate earnings are a function of consumptive spending, corporate investments, imports, and exports. The market disconnect from underlying economic activity is due to psychology. Such is particularly the case over the last decade, as successive rounds of monetary interventions led investors to believe ‘this time is different.’”

There is a correlation between economic activity and the rise and fall of equity prices. For example, in 2000 and again in 2008, corporate earnings contracted by 54% and 88%, respectively, as economic growth declined. Such was despite calls for never-ending earnings growth before both previous contractions.

As earnings disappointed, stock prices adjusted by nearly 50% to realign valuations with weaker-than-expected current earnings and slower future earnings growth. So, while stock markets are once again detached from reality, looking at past earnings contractions suggests such deviations are not sustainable.

With the current market capitalization to GDP ratio data outside the historical range as economic growth slows, you can understand Berkshire’s dilemma of deploying cash.

The risk of overpaying for assets comes down to sustaining current profitability.

Berkshire’s issue of finding “reasonably priced” acquisitions is not just one of being overly picky about opportunities. After more than a decade of monetary infusions and zero interest rates, most companies are priced well beyond what economic dynamics can support.

The second message from Buffett’s cash hoard was more of a warning.

Buffett’s Cash Looking For A Crash?

“Occasionally, markets and/or the economy will cause stocks and bonds of some large and fundamentally sound businesses to be strikingly mispriced. Indeed, markets can – and will – unpredictably seize up or vanish as they did for four months in 1914 and a few days in 2001. If you believe American investors are now more stable than in the past, think back to September 2008. Speed of communication and the wonders of technology facilitates instant worldwide paralysis, and we have come a long way since smoke signals. Such instant panics won’t happen often – but they will happen.

Berkshire’s ability to immediately respond to market seizures with both huge sums and certainty of performance may offer us an occasional large-scale opportunity. Though the stock market is massively larger than it was in our early years, today’s active participants are neither more emotionally stable nor better taught than when I was in school. For whatever reasons, markets now exhibit far more casino-like behavior than when I was young. The casino now resides in many homes and daily tempts the occupants.

One investment rule at Berkshire has not and will not change: Never risk permanent loss of capital. Thanks to the American tailwind and the power of compound interest, the arena in which we operate has been – and will be – rewarding if you make a couple of good decisions during a lifetime and avoid serious mistakes.” – Warren Buffett

In other words, he holds such high cash levels to take advantage of market dislocations. Such is what happened in 2008 when the prestigious “white shoe” investment firm of Goldman Sachs came begging with “hat in hand” for a bailout to avoid bankruptcy. Buffett was glad to oblige by providing a massive infusion of capital at lucrative terms. During a crisis, those who “have the gold make the rules.”

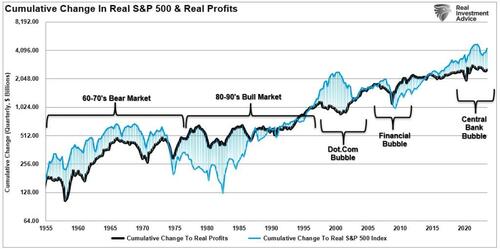

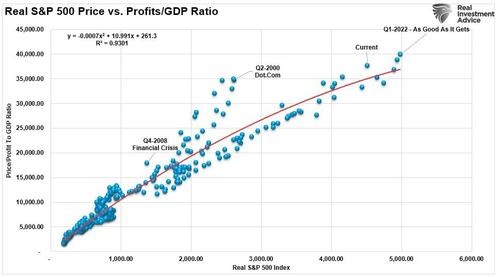

Is there such an opportunity coming in the future? The answer is most likely yes. If we examine corporate profits as they relate to economic growth, we find another measure of excess. The chart below measures the cumulative change in the S&P 500 index compared to corporate profits. Again, when investors pay more than $1 for $1 worth of profits, those excesses are eventually reversed. The current deviation of the market from underlying profitability suggests that eventual reversion will be pretty unkind to investors.

The correlation is more evident in the market versus the price-to-corporate profits ratio. Again, since corporate profits are ultimately a function of economic growth, the correlation is not unexpected. Hence, neither should the impending reversion in both series. Currently, that ratio is approaching levels that preceded more significant market reversions to realign the markets to profitability.

As noted, the high correlation is unsurprising. Investors should expect an eventual reversal with the market on the more extreme end of the valuation spectrum. However, those reversals can take much longer to occur than logic would assume.

Investors believe the deviation between fundamentals and fantasy doesn’t matter as long as the Fed supports asset prices. Such a point remains challenging to argue.

However, as is always the case, the reversion of excesses will occur. Buffett’s cash hoard suggests that he realizes that such a reversion is not unprecedented. More importantly, he wants to capitalize on it when it occurs.

-

Site: Ron Paul Institute for Peace And Prosperity

The United States Constitution specifies that gold and silver are money. “No State shall … make any Thing but gold and silver Coin a Tender in Payment of Debts,” declares the Constitution. Further, one of the enumerated powers the Constitution lists for the US Congress is the power to “coin Money” (not print money) and “regulate the Value thereof.” Indeed, coining money containing gold and silver was ordered by the new US Congress via the Coinage Act of 1792. Lower value coins such as pennies and half pennies containing copper also circulated.

Using gold and silver as money put restraint on government spending. Coins could only be produced if the precious metals were first obtained. And there was a limit to the circulation of paper currency as well so long as it was certificates holders could redeem for gold or silver. Print too much, and the currency would collapse in value with the failure to honor redemption.

Today, however, US currency and coins are far removed from the nature envisioned in the Constitution. Gold coins were withdrawn in the 1930s. Then, in the 1960s silver was replaced in half dollar, quarter, and dime coins. Most of the copper was replaced with zinc in pennies in the 1980s. Nickels themselves may soon be made mainly of something other than copper and nickel as nickels now have a metal value higher than their face value. As far as half pennies, it is long past the time new ones have been made or any are seen routinely in circulation.

Without the discipline imposed by gold and silver, inflation has been so extreme that the 1960s and earlier coins containing silver are now, measured in dollars, worth over twenty times their face value; the amount is over one hundred times for gold coins from the 1930s and earlier.

In short, the American people have been robbed. The Constitution was supposed to protect them, but in the end it did not.

There is some hope for a return to sound money — money held in check by its precious metals content. Some of this hope arises from action in state governments to remove barriers to the practicality of people using gold and silver as money. One key action is eliminating the taxation of gold and silver upon its sale or exchange. Jp Cortez wrote last week at the Mises Institute about Nebraska becoming the 12th state to eliminate state capital gains taxes on sales and exchanges of gold and silver.

Also last week, Rep. Alex Mooney (R-WV) reintroduced his Monetary Metals Tax Neutrality Act (HR 8279) in the US House of Representatives. The bill seeks to remove the US capital gains tax burden from gold and silver sales and exchanges. A press release from the Sound Money Defense League, where Cortez works as executive director, quotes Mooney as follows regarding his bill:

‘My view, which is backed up by language in the U.S. Constitution, is that gold and silver coins are money and are legal tender,’ Rep. Mooney said.

‘If they’re indeed U.S. money, it seems there should be no taxes on them at all. So, why are we taxing these coins as collectibles?’

Right on. Hopefully, more states will keep eliminating taxes on gold and silver sales and exchanges, along with other legal measures inhibiting the holding and using of precious metals. And, hopefully, majority support will emerge in the US Congress for reinstating respect for constitutionally supported sound money.

-

Site: Mises InstituteMises Fellow, Mateusz "Matt" Machaj joins Bob to discuss his new booklet from Routledge, which explains how mainstream economists have responded to the recent bout of price inflation.

-

Site: Mises InstituteProgressives are claiming that corporate profits are one of the causes of inflation. However, if inflation increases consumer prices, it also causes production costs to rise. That is not a recipe for profitability.

-

Site: Steyn OnlineThe Mark Steyn Club is celebrating its seventh birthday this month, and we thank all our old friends from May 2017 who've decided to hop on board for our eighth year. Ray, a First Week Founding Member from Oregon, writes: I feel honored to be an early

-

Site: Steyn OnlineProgramming note: As part of the seventh-birthday jubilations of The Mark Steyn Club, please join me for our brand new weekly music show. It airs every Saturday on Serenade Radio at 5pm UK time/12 midday North American Eastern. You can listen from almost

-

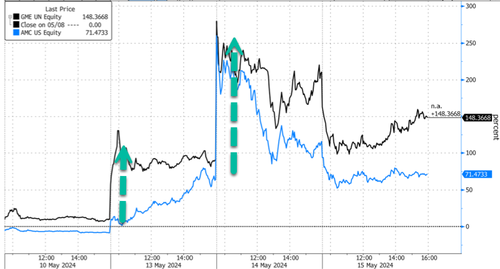

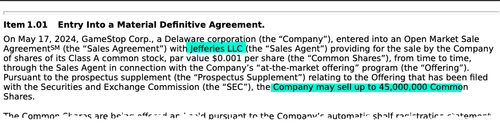

Site: Zero HedgeGameStop Crashes On Plan To Dump 45 Million Shares On MarketTyler Durden Fri, 05/17/2024 - 10:00

Sunday:

— Roaring Kitty (@TheRoaringKitty) May 13, 2024Roaring Kitty's post on X unleashed a mega short squeeze in heavily shorted Gamestop and AMC Entertainment Holdings between Monday and Wednesday.

On the first day of the mania, we pointed out, "You know Jefferies bankers are burning the phones at GME and AMC pitching ATM equity offerings for after the close."

You know jefferies bankers are burning the phones at GME and AMC pitching ATM equity offerings for after the close

— zerohedge (@zerohedge) May 13, 2024Then Tuesday.

And there it is

— zerohedge (@zerohedge) May 14, 2024

AMC Raised About $250M of New Equity Capital in ATM Offering

Thank you retail investors https://t.co/MPu8vfEmNzAnd Wednesday (read here).

Gamestop and AMC's price action from the start of Wednesday through yesterday's close has been absolutely awful.

And finally, to end the week, Gamestop entered into an open market sale agreement with Jefferies to sell up to 45 million shares.

Shares cratered in premarket trading, down 23% to 21.32.

Here's the price action recap for both Gamestop and AMC for the week.

Thanks for playing retail.

-

Site: LifeNews

Christians on X are rallying behind Kansas City Chiefs kicker Harrison Butker for his commencement speech at a Catholic college in Kansas, especially after his remarks were met with backlash from the NFL and secular media.

Butker encouraged the Benedictine College graduates on May 12 “to be authentically and unapologetically Catholic,” as CatholicVote previously reported.

In the speech, he condemned abortion, in vitro fertilization, surrogacy, “Pride month,” and euthanasia. He also spoke of his love for the traditional Latin Mass, and about the importance of living out one’s vocation according to God’s will to become a saint.

His address went viral, and was met with vocal criticism from people who took offense at his words. In response to the backlash, many Catholics and conservatives on X have since been expressing their support of the commencement address.

Additionally, College Football Hall of Fame Coach Lou Holtz expressed his support of Butker’s speech.

“Thank you [Harrison Butker] for standing strong in your faith values,” Holtz wrote on his X account. “Your commencement speech at Benedictine College showed courage and conviction and I admire that. Don’t give in.”

HELP LIFENEWS SAVE BABIES FROM ABORTION! Please help LifeNews.com with a donation!

Holtz also included a link to a statement in support of Butker, and wrote: “Sign here to thank Super Bowl Champion Harrison Butker, a true man of God.”

Catholic Daily Wire podcast host Michael Knowles wrote in a post on his X account, “[Butker’s speech] is without question, beginning to end, the greatest college commencement speech delivered in my lifetime.”

During his podcast show on May 16, Knowles expanded on his statement and played an excerpt from the speech when Butker spoke about his love for his wife.

“I can tell you that my beautiful wife, Isabelle, would be the first to say that her life truly started when she began living her vocation as a wife and as a mother. I’m on the stage today and able to be the man I am because I have a wife who leans into her vocation,” Butker said, according to a transcript of his speech published by the National Catholic Register.

Butker began to hold back tears as he continued, “I’m beyond blessed with the many talents God has given me, but it cannot be overstated that all of my success is made possible because a girl I met in band class back in middle school would convert to the faith, become my wife, and embrace one of the most important titles of all: homemaker.”

Knowles then said on his show, “The man here is on the verge of tears, pouring out an expression of love for his wife, and the libs and the feminists are accusing him of misogyny–for saying that he loves his wife and [that] she excels in her role as homemaker and a mother and a wife.”

Grazie Pozo Christie, M.D., a doctor and member of the Catholic Association, also praised Butker’s speech on her X account, writing:

Lovely speech.

The leftist pearl-clutchers are horrified at the term “homemaker”.

They pretend they don’t know that the West is full of mothers working for money for a random boss in an office or factory when they’d give anything to be home working for love of their children and husband.

On May 15, the NFL gave People Magazine an official statement about Butker’s speech that reads: “Harrison Butker gave a speech in his personal capacity. His views are not those of the NFL as an organization. The NFL is steadfast in our commitment to inclusion, which only makes our league stronger.”

Sean Davis, founder of the online conservative publication the Federalist, slammed the hypocrisy of the NFL’s statement about Butker’s speech.

“The NFL was quicker to condemn Butker for being a Christian than it was to condemn Ray Rice for caving in his fiancee’s head on camera and then dragging her lifeless body through the hall,” he wrote in a post on X.

Clay Travis, an author and lawyer, wrote of the NFL statement on his X account: “The NFL has publicly condemned Harrison Butker’s private political opinions. Has the league ever publicly condemned any other player’s private political opinions or comments for any reason? I can’t recall it.”

A Catholic priest on X, Fr. R. Vierling, posted, “Any statement from the [NFL] on its players convicted of crimes? It seems the only offense for the #NFL is a Roman Catholic man proclaiming Catholic teaching on a Catholic campus before a Catholic audience.”

A petition was formed on Change.org calling for Butker to be dismissed from playing for the Chiefs because of his remarks.

One Catholic account on X, LanguageGeek95, responded to this petition with a post that read: “They’ll say they’re tolerant of your Catholicism until you say you believe what the Church teaches.”

The LOOPCast host Tom Pogasic also responded to the petition, writing on his X account:

So we have to listen to athletes and celebrities lecture us on climate change, transing children, COVID, the evil of white people, Men in women’s sports, and abortion.

But expressing basic Catholic views is a bridge too far.

Got it.

EWTN Digital Media Specialist Christina Herrera responded to the petition similarly, writing on her X account:

We have to listen to celebrities and athletes push/celebrate abortion, pride month, IVF, men purchasing babies via surrogacy, trans surgeries for minors, and other morally reprehensible positions on a regular basis but Catholics can’t offer their point of view?

We aren’t allowed to openly talk about our faith in a Catholic setting? We can’t push back and publicly praise Jesus and His sacraments? We can’t publicly acknowledge the sanctity of Holy Matrimony, motherhood, fatherhood, or any traditional viewpoint? We can’t call a sin a sin?

Suddenly it’s hate speech?

Make it make sense.

In a more ironic tone, Catholic author Jesse Kelly wrote of the commencement controversy on his X account: “Harrison Butker is dead wrong about women and you can tell by how calmly his comments were received. Clearly he insulted some very happy, content people.”

In another X post, Christiana Herrera pointed out: “[I don’t know] who needs to hear this but Butker received a standing ovation from the crowd.”

LifeNews Note: McKenna Snow writes for CatholicVote, where this column originally appeared.

The post Coach Lou Holtz Applauds Harrison Butker: Your Speech Showed “Courage and Conviction” appeared first on LifeNews.com.

-

Site: Zero HedgeWorld's #1 Golfer Tossed Against Car, Arrested In Kentucky -- Calls "Very Chaotic Situation"Tyler Durden Fri, 05/17/2024 - 09:40

The world's #1 golfer Scottie Scheffler was arrested and taken to jail on several charges - including a felony charge of assaulting a police officer, after he tried to bypass a massive traffic backup to enter the Valhalla Golf Club in Louisville Kentucky.

Scheffler was set to tee off for his second round of the PGA Championship at 8:48 ET alongside Wyndham Clark and Brian Harman, when he was detained and booked.

In viral footage, Scheffler was seen being led into the police car in handcuffs.

Here is video that I took of Scheffler being arrested: https://t.co/8UPZKvPCCf pic.twitter.com/9Tbp2tyrJh

— Jeff Darlington (@JeffDarlington) May 17, 2024"Can you please help me?" he was heard asking a nearby journalist.

Scheffler reportedly thought he was bypassing security staff, when it was in fact cops who told him to stop due to an earlier traffic accident that he was not involved in. When he didn't, the officer attached himself to the golfer's car - which Scheffler drove approximately 30 feet before stopping, ESPN reports.

Full details on Scottie Scheffler’s arrest, excellent reporting by @JeffDarlington.

— Kevin Negandhi (@KevinNegandhi) May 17, 2024

pic.twitter.com/GnRFR9gEgSThe officer is then said to have grabbed at Scheffler's car, attempting to pull him out before Scheffler opened the door - after which he was dragged out of the vehicle, thrown up against it, and placed in handcuffs.

The 27-year-old golfer was later booked into jail and released by the Louisiana Department of Corrections.

He's been charged with:

- Second-degree assault of a police officer, which is a felony

- Third-degree criminal mischief

- Reckless driving

- Disregarding traffic signals from an officer directing traffic

Following the arrest, ESPN reporter Jeff Darlington said "One police officer came up to me with his pad and said - pen in hand - "Can you tell me the name of the person we've just arrested?""

Earlier, when Darlington tried to get the attention of the officers, he was warned "Back up or you're going to jail also!"

"Right now, he's going to jail," another officer said. "He's going to jail and there's nothing you can do about it. Period."

Update: Scheffler, meanwhile, has described the arrest as a "big misunderstanding" following "a very chaotic situation."

This morning, I was proceeding as directed by police officers. It was a very chaotic situation, understandably so considering the tragic accident that had occurred earlier, and there was a big misunderstanding of what I thought I was being asked to do. I never intended to disregard any of the instructions. I’m hopeful to put this to the side and focus on golf today.

Statement from Scottie Scheffler to me: “This morning, I was proceeding as directed by police officers. It was a very chaotic situation, understandably so considering the tragic accident that had occurred earlier, and there was a big misunderstanding of what I thought I was…

— Jeff Darlington (@JeffDarlington) May 17, 2024Scottie Scheffler this morning: pic.twitter.com/jPHyDVyma4

— StevenM (@mobster84) May 17, 2024Rory driving past Scottie Scheffler this morning pic.twitter.com/dVhDBDpN4p

— Shooter McGavin (@ShooterMcGavin_) May 17, 2024 -

Site: LifeNews

CatholicVote President Brian Burch has called on the NFL’s leaders to clarify whether Catholics are welcome in the NFL in light of their statement denouncing the commencement speech given by Kansas City Chiefs kicker Harrison Butker at a Catholic college in Kansas.

“In that speech, for which he received a standing ovation, Butker called on Catholics to live up to the high ideals of our Faith, including the defense of the dignity of every human life, the foundational role of the family, and the gift of motherhood,” Burch wrote on May 16 to NFL Commissioner Roger Goodell and Kansas City Chiefs CEO Clark Hunt.

“These ideals are not controversial for millions of Americans and indeed remain sacred for millions of religious believers, including millions of your fans and customers,” Burch wrote. Nonetheless, a “recent statement by the league distancing itself from Butker for his remarks calls into question your commitment to genuine diversity and inclusion.”

Burch noted that the NFL claims it “honors and celebrates the broad ranges of human difference among us, while also embracing the commonalities we share, and to provide each individual with the opportunity to achieve their full potential.”

“Does this inclusion include Catholics, pro-life Americans, mothers, and those who hold to traditional moral beliefs? We certainly hope you will continue to ignore the reckless calls for Mr. Butker to be canceled, or worse,” Burch wrote:

HELP LIFENEWS SAVE BABIES FROM ABORTION! Please help LifeNews.com with a donation!

We understand not every American, or NFL fan for that matter, may share the same opinions or beliefs as Mr. Butker.

We are hopeful, however, that you do not intend to send a message to Catholics, or to those that still uphold basic moral tenets of a civilized society, that they are outsiders and no longer welcome.

CatholicVote is also calling on Catholics to sign a petition in support of Butker, which can be accessed here.

LifeNews Note: McKenna Snow writes for CatholicVote, where this column originally appeared.

The post If the NFL Truly Values Inclusion, It Should Include Harrison Butker’s Christian Views appeared first on LifeNews.com.

-

Site: AsiaNews.itThree people have died and hundreds have been injured in recent clashes between police and pro-independence protesters in the French Overseas Territory. For the Pacific Conference of Churches (PCC), 'It cannot be ignored that eruption of violence is the manifestation of the pain, trauma and frustration of a community who have consistently had their indigenous and political rights undermined.'

-

Site: Zero HedgeTurley: Will The Trump Jury Realize They Are Being Played By The ProsecutionTyler Durden Fri, 05/17/2024 - 09:25

Below is my column in Fox.com on the approaching end of the Trump trial in Manhattan. With the dramatic implosion of Michael Cohen on the stand on Thursday with the exposure of another alleged lie told under oath, even hosts and commentators on CNN are now criticizing the prosecution and doubting the basis for any conviction. CNN anchor Anderson Cooper admitted that he would “absolutely” have doubts after Cohen’s testimony.

CNN’s legal analyst Elie Honig declared “I don’t think I’ve ever seen a star cooperating witness get his knees chopped out quite as clearly and dramatically.”

He previously stated that this case would never have been brought outside of a deep blue, anti-Trump district. Other legal experts, including on CNN and MSNBC, admitted that they did not get the legal theory of the prosecution or understand the still mysterious crime that was being concealed by the alleged book-keeping errors. The question is whether the jury itself is realizing that they are being played by the prosecution.

Here is the column:

In the movie “Quiz Show,” about the rigging of a 1950s television game show, the character Mark Van Doren warns his corrupted son that “if you look around the table and you can’t tell who the sucker is, it’s you.”

As the trial of former President Donald Trump careens toward its conclusion, one has to wonder if the jurors are wondering the same question.

For any discerning juror, the trial has been conspicuously lacking any clear statement from the prosecutors of what crime Trump was attempting to commit by allegedly mischaracterizing payments as “legal expenses.” Even liberal legal experts have continued to express doubt over what crime is being alleged as the government rests its case.

There is also the failure of the prosecutors to establish that Trump even knew of how payments were denoted or that these denotations were actually fraudulent in denoting payments to a lawyer as legal expenses.

The judge has allowed this dangerously undefined case to proceed without demanding greater clarity from the prosecution.

Jurors may also suspect that there is more to meet the eye about the players themselves. While the jurors are likely unaware of these facts, everyone “around the table” has controversial connections. Indeed, for many, the judge, prosecutors, and witnesses seem as random or coincidental as the cast from “Ocean’s Eleven.” Let’s look at three key things.

1. The Prosecutors

First, there are the prosecutors. Manhattan District Attorney Alvin Bragg originally (as did his predecessor) rejected this ridiculous legal theory and further stated that he could not imagine ever bringing a case where he would call former Trump personal attorney Michael Cohen, let alone make him the entirety of a prosecution.

Bragg’s suspension of the case led prosecutor Mark F. Pomerantz to resign. Pomerantz then wrote a book on the prosecution despite his colleagues objecting that he was undermining their work. Many of us viewed the book as unethical and unprofessional, but it worked. The pressure campaign forced Bragg to green-light the prosecution.

Pomerantz also met with Cohen in pushing the case.

Bragg then selected Matthew Colangelo to lead the case. Colangelo was third in command of the Justice Department and gave up that plum position to lead the case against Trump. Colangelo was also paid by the Democratic National Committee for “political consulting.” So a former high-ranking official in the Biden Justice Department and a past consultant to the DNC is leading the prosecution.

2. The Judge

Judge Juan Merchan has been criticized not only because he is a political donor to President Biden but his daughter is a high-ranking Democratic political operative who has raised millions in campaigns against Trump and the GOP.

Merchan, however, was not randomly selected. He was specifically selected for the case due to his handling of an earlier Trump-related case.

3. The Star Witness

Michael Cohen’s checkered history as a convicted, disbarred serial perjurer is well known. Now, Rep. Dan Goldman, D-N.Y., is under fire after disclosing that “I have met with [Cohen] a number of times to prepare him.”

Goldman in turn paid Merchan’s daughter, Loren Merchan, more than $157,000 dollars for political consulting.

Outside the courtroom, there is little effort to avoid or hide such conflicts. While Democrats would be outraged if the situation were flipped in a prosecution of Biden, the cross-pollination between the DOJ, DNC, and Democratic operatives is dismissed as irrelevant by many in the media.

Moreover, there is little outrage in New York that, in a presidential campaign where the weaponization of the legal system is a major issue, Trump is not allowed to discuss Cohen, Colangelo, or these conflicts. A New York Supreme Court judge is literally controlling what Trump can say in a presidential campaign about the alleged lawfare being waged against him.

The most striking aspect of these controversial associations is how little was done to avoid even the appearance of conflicts of interests. There were many judges available who were not donors or have children with such prominent political interests in the case. Bragg could have selected someone who was not imported by the Biden administration or someone who had not been paid by the DNC.

There was no concern over the obvious appearance of a politically motivated and stacked criminal case. Whether or not these figures are conflicted or compromised, no effort was taken to assure citizens that any such controversies are avoided in the selection of the key players in this case.

What will be interesting is how the jury will react when, after casting its verdict, the members learn of these undisclosed associations. This entire production was constructed for their benefit to get them to convict Trump despite the absence of a clear crime or direct evidence.

They were the marks and, like any good grift, the prosecutors were counting that their desire for a Trump conviction would blind them to the con.

Bragg, Colangelo and others may be wrong. Putting aside the chance that Judge Merchan could summon up the courage to end this case before it goes to the jury, the grift may have been a bit too obvious.

New Yorkers are a curious breed. Yes, they overwhelmingly hate Trump, but they also universally hate being treated like chumps. When they get this case, they just might look around the courtroom and decide that they are the suckers in a crooked game.

-

Site: Mises Institute

-

Site: AsiaNews.itAccording to the Israeli army they were killed immediately on 7 October during the attack on kibbutz Be'eri. The fate of six other Bangkok citizens believed to be in the hands of Hamas remains unknown, as does Nepalese student Bipin Joshi, Meanwhile, thousands of Thais are trying to find work again in Israel as farmers.

-

Site: LES FEMMES - THE TRUTH

-

Site: Zero HedgeIs US Copper Sowing The Seeds Of Its Own Return To Earth?Tyler Durden Fri, 05/17/2024 - 08:50

Authored by Simon White, Bloomberg macro strategist,

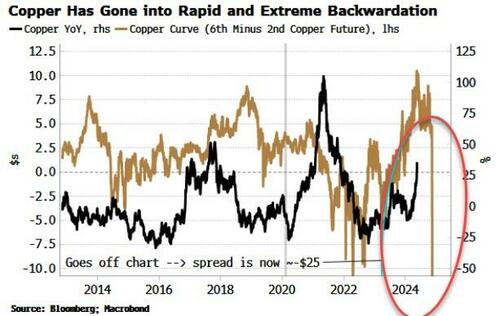

Copper’s recent rally has been most pronounced in the US, taking the futures curve there into extreme backwardation. That typically precedes a supply response and lower prices. Nonetheless, the long-term bullish case for copper is intact.

Copper trades in three main exchanges:

- Comex in the US,

- the London Metal Exchange and

- the Shanghai Futures Exchange.

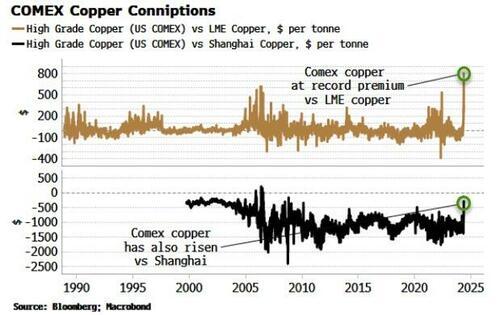

It has risen globally in recent weeks, but the rally at Comex has eclipsed the other two.

While stocks in Shanghai have risen sharply this year, and in London they have fallen but remain well above zero, at Comex warehouses they have fallen to near zero. This has led to massive short squeeze in US copper, with the metal trading at its highest ever premium to LME copper at over $800 per tonne (and much higher on an intraday basis).

This has pushed the Comex copper futures curve into massive backwardation, i.e. spot prices trading well above futures prices.

However, this often eventually leads to a self-correction. High spot prices encourage more supply to come on to the market, depressing the spot price and normalizing the curve. Today’s level of backwardation suggests this could be more pronounced than normal.